Teradyne, a semiconductor testing equipment supplier, forecast first-quarter revenue lower than Wall Street expectations due to reduced demand for its chip-testing equipment.

Teradyne, a supplier of semiconductor testing equipment, predicted first-quarter revenue lower than Wall Street projections on Tuesday, citing weaker demand for its chip-testing equipment.

The company’s shares sank by about 6% in extended trade.

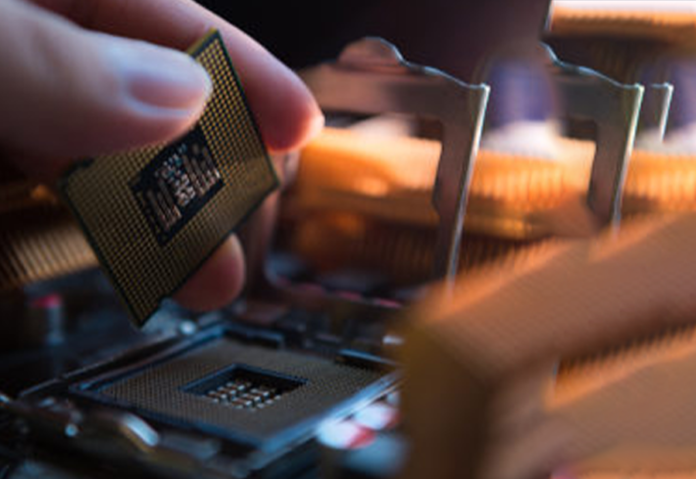

Teradyne produces and develops technologies for testing chips and electrical equipment, as well as selling robotic systems to manufacturers.

Teradyne’s revenue has been dropping year on year in recent quarters as the chip-testing equipment provider deals with lower demand for its products as clients cut back on spending in an uncertain economy.

“Looking into the new year, we expect low tester utilization to impact demand in the first half of the year,” Teradyne CEO Greg Smith explained.

Teradyne warned in November that the ongoing Israel-Hamas conflict will have a severe impact on its future revenue and supply chain.

According to LSEG statistics, the company, which sells equipment to chip designer Qualcomm and electronics major Samsung, expects first-quarter revenue in the range of $540 million to $590 million, up from projections of $625.1 million.

It also forecasts adjusted profits per share for the first quarter in the range of 22 cents to 38 cents, compared with estimates of 53 cents.

Net revenue for the fourth quarter was $670.6 million, lower than analysts’ projections of $674.7 million.

Do Follow: CIO News LinkedIn Account | CIO News Facebook | CIO News Youtube | CIO News Twitter

About us:

CIO News, a proprietary of Mercadeo, produces award-winning content and resources for IT leaders across any industry through print articles and recorded video interviews on topics in the technology sector such as Digital Transformation, Artificial Intelligence (AI), Machine Learning (ML), Cloud, Robotics, Cyber-security, Data, Analytics, SOC, SASE, among other technology topics.