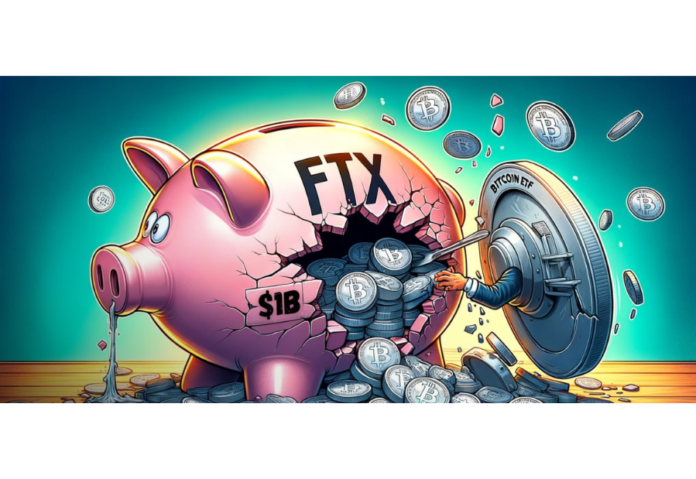

FTX has sold 22 million shares of Grayscale Bitcoin Trust (GBTC), worth roughly $1 billion.

FTX has sold 22 million shares of Grayscale Bitcoin Trust (GBTC) worth nearly $1 billion since it was transformed into an exchange-traded fund (ETF) earlier this month, reducing FTX’s GBTC stake to zero, it was reported.

According to the report, GBTC has seen outflows of more than $2 billion since its conversion into an ETF, citing private data examined.

“Large capital markets ETFs are used in a variety of investing strategies, and we anticipate that GBTC’s diverse shareholder base will continue to deploy strategies that impact inflows and outflows,” a Grayscale representative stated.

Grayscale was permitted to convert its current bitcoin trust into an ETF, resulting in the world’s largest bitcoin ETF with over $28.6 billion in assets under management.

After a decade-long battle with the digital asset industry, the United States Securities and Exchange Commission has approved 11 spot bitcoin ETFs, including BlackRock’s iShares Bitcoin Trust (IBIT.O), Grayscale Bitcoin Trust (GBTC.P), and ARK 21Shares Bitcoin ETF (ARKB.Z), which opens a new tab.

The acceptance was a landmark moment, increasing the legitimacy of the cryptocurrency business and propelling bitcoin farther into the mainstream.

Do Follow: CIO News LinkedIn Account | CIO News Facebook | CIO News Youtube | CIO News Twitter

About us:

CIO News, a proprietary of Mercadeo, produces award-winning content and resources for IT leaders across any industry through print articles and recorded video interviews on topics in the technology sector such as Digital Transformation, Artificial Intelligence (AI), Machine Learning (ML), Cloud, Robotics, Cyber-security, Data, Analytics, SOC, SASE, among other technology topics.