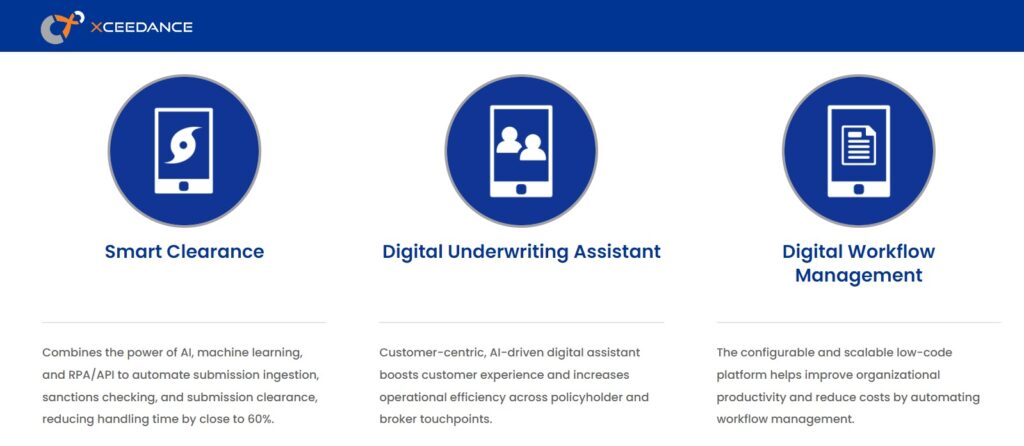

The global insurtech market, valued at USD 3.85 billion in 2021, is predicted to expand at a compound annual growth rate (CAGR) of 51.7% between 2022 and 2030. The Xceedance Digital Solutions unit aims to be a digital transformation player for insurers and MGAs, with a team of insurance and technology experts focused on building innovative platforms to alter and streamline operations in the insurance space. Xceedance recently launched three innovative products to drive digital transformation in the insurance market: a digital workflow management tool, Smart Clearance, an artificial intelligence-backed submission clearance solution, and a digital underwriting assistant.

Digital Workflow Management

Addressing critical workflow management challenges faced by insurance organizations, the Xceedance Digital Workflow Management solution automates task creation, query management, and end-to-end SLA/TAT management, enabling no-touch task distribution and allocation. It strengthens controls with greater visibility and enhances collaboration and business agility, driving continuous process improvement. Moreover, the solution integrates easily with policy administration, billing, claims, email, document management, and other critical business systems.

Smart Clearance

P&C and commercial insurance submission and loss analysis are manual, tedious, and time-consuming processes. Brokers and agents send different documents and file formats to insurers, and considerable effort is needed to extract the required data from multiple non-standardized sources. Xceedance Smart Clearance, an innovative insurance auto submission tool, automates the entire journey of an insurance submission process by using technology to address critical aspects like data extraction, data enrichment, data validation, pre-clearance, and submission tracking.

Digital Underwriting Assistant

An AI/ML-powered modern loss and exposure data analysis solution, the Xceedance Digital Underwriting Assistant automates processing loss run reports and exposure data. It helps insurers and MGAs eliminate the tiring manual process of identifying and extracting unstructured data from different carriers’ proprietary systems and storing that in spreadsheets.

“Business processes in the P&C and commercial insurance sectors are often manual, error-prone, and inefficient,” said Jainendra (Jai) Kumar, vice president – digital transformation unit at Xceedance. “Solutions like Smart Clearance, Digital Workflow Management, and Digital Underwriting Assistant can enhance process efficiency by 20 to 30 percent while improving accuracy, improving time to quote, and reducing cost. Now is the time for insurers to adopt transformational digital technology to improve efficiency and optimise cost while getting better prepared for changes in the distribution ecosystem.”

These innovative products from Xceedance are ready to transform your insurance operations. Learn more about our digital solutions at Xceedance.com/digitalsolutions or contact Xceedance.

Do Follow: CIO News LinkedIn Account | CIO News Facebook | CIO News Youtube | CIO News Twitter

About us:

CIO News, a proprietary of Mercadeo, produces award-winning content and resources for IT leaders across any industry through print articles and recorded video interviews on topics in the technology sector such as Digital Transformation, Artificial Intelligence (AI), Machine Learning (ML), Cloud, Robotics, Cyber-security, Data, Analytics, SOC, SASE, among other technology topics