An Open-Ended Equity Scheme representing the India Manufacturing Theme

Key Highlights: –

-

Category: Thematic

-

Scheme Details: An Open-Ended Equity Scheme representing the India Manufacturing Theme

-

Fund Managers: Nitin Arora and Shreyash Devalkar

-

Gross Sales: Over INR 3,400 crores

-

Applications received: Around One Lakh Fifty Thousand

The overwhelming response underscores the confidence that investors have placed in India’s growth potential and Axis Mutual Fund’s commitment to deliver value.

Bengaluru, December 22, 2023: Axis Mutual Fund, one of the fastest-growing fund houses in India, is excited to announce that it has garnered over INR 3,400 crores in the Axis India Manufacturing Fund, one of the highest funds raised ever in a thematic fund this year. This NFO, from December 1 to December 15, 2023, received robust participation from diverse investor segments from over 500 locations in India and garnered close to one lakh fifty thousand applications. Further, fresh inflows accounted for nearly 70% of the applications, making the NFO a resounding success. The digital channel witnessed overwhelming participation as well, contributing to nearly 20% of the total applications, creating a new milestone for the Fund House.

In fact, in one of the first of its kind for the fund house, unique customers from B30 markets accounted for nearly 44%, standing on an almost equal footing with T30 markets. The overwhelming response from B30 markets is a clear reflection of the financially maturing Bharat and investor aspirations.

- Gopkumar, MD & CEO, Axis AMC, commented, “The overwhelming response underscores the confidence that investors have placed in India’s growth potential and Axis Mutual Fund’s commitment to deliver value. A significant ~10% of the applicants opted for long-term investments through SIPs (Systematic Investment Plans). Almost 30% of the investors who invested in the NFO were new to Axis Mutual Fund, advocating their faith in us. This strong response marks the evolution of India’s investor base, which is demonstrating resilience and preference for such funds while understanding the long-term opportunities to leverage, given the fact that India remains on a higher growth trajectory and the government’s strong focus on manufacturing.”

For detailed information on the investment strategy and to view the Scheme Information Document (SID) or Key Information Memorandum (KIM), please visit www.axismf.com.

Sources: Axis MF Research as on 16th Dec 202

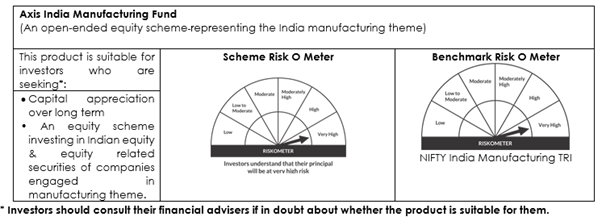

Product Labelling and Riskometer:

AXIS INDIA MANUFACTURING FUND (An open-ended equity scheme representing the India Manufacturing Theme)

Do Follow: CIO News LinkedIn Account | CIO News Facebook | CIO News Youtube | CIO News Twitter

About us:

CIO News, a proprietary of Mercadeo, produces award-winning content and resources for IT leaders across any industry through print articles and recorded video interviews on topics in the technology sector such as Digital Transformation, Artificial Intelligence (AI), Machine Learning (ML), Cloud, Robotics, Cyber-security, Data, Analytics, SOC, SASE, among other technology topics.