The US Treasury revealed that it had imposed fines on Russian fintech companies, including blockchain firm Atomyze, for inventing or providing virtual asset services.

The US Treasury announced on Monday that it had slapped penalties on Russian financial services and technology players, including blockchain firm Atomyze, for developing or supplying virtual asset services in order to evade Ukraine war-related sanctions on Russia.

The Treasury’s Office of Foreign Assets Control (OFAC) named 13 businesses and two persons in the most recent round of sanctions targeting Russia’s fundamental financial infrastructure, preventing it from using the international financial system to achieve its Ukraine conflict goals.

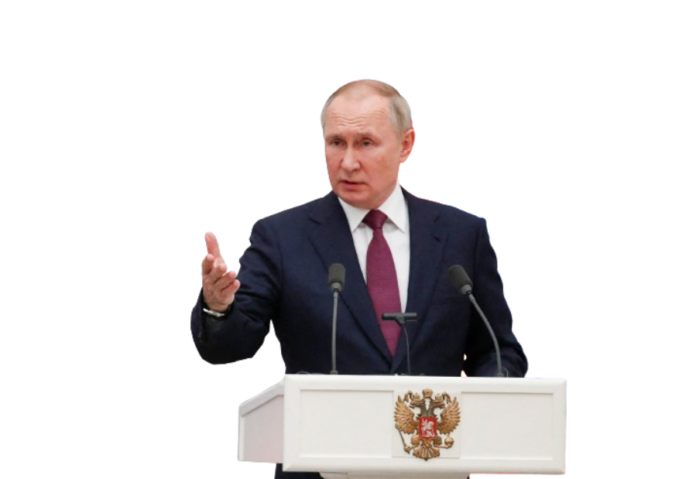

Five of the entities were classified as being owned or controlled by individuals who had already been sanctioned by OFAC. Atomyze, a fintech startup owned by sanctioned Russian billionaire Vladimir Potanin’s Interros Holding investment group, is one of the companies targeted.

Treasury said Atomyze was chosen for its work to tokenize precious metals and diamonds for Russian firms, as well as its collaboration with sanctioned Russian banks Rosbank and Sovcombank.

Atomyze received Russia’s first government license to issue and exchange digital financial assets in February 2022, only three weeks before Russian armies invaded Ukraine. Atomyze introduced the first digital token backed by palladium in July 2022, which was manufactured by Nornickel, a sanctioned metals production operated by Potanin.

OFAC’s specially designated nationals list also includes fintech startup Lighthouse, which in June 2022 completed the first cash-backed Russian digital asset transaction. Treasury stated that Lighthouse collaborated with Russia’s sanctioned central bank as well as sanctioned big lenders VTB and Sberbank.

Other financial technology firms sanctioned by OFAC include B-Crypto, Masterchain, and Veb3 Technology, according to the Treasury. The sanctions usually prohibit the designees from engaging in US dollar transactions or accessing the US financial system.

Also read: Women in the technology industry is constantly increasing, says Rajita Bhatnagar

Do Follow: CIO News LinkedIn Account | CIO News Facebook | CIO News Youtube | CIO News Twitter

About us:

CIO News, a proprietary of Mercadeo, produces award-winning content and resources for IT leaders across any industry through print articles and recorded video interviews on topics in the technology sector such as Digital Transformation, Artificial Intelligence (AI), Machine Learning (ML), Cloud, Robotics, Cyber-security, Data, Analytics, SOC, SASE, among other technology topics.