Fintech and challenger banks are proving that cloud-based operations are successful, and customers enjoy the accessibility as well as the look and feel of new service offerings

This is an exclusive interview conducted by Santosh Vaswani, Editor at CIO News with Mr. Sundar Kasturirangan, Senior Director- Fintech & Payments, Techwave on “Banking Application Modernization.”

Digital transformation in banking is not just a change. It is more than just moving far ahead from the layers of legacy systems to the digital world. The core of digital transformation starts with understanding the core of digital customer behavior, wants, and needs. The reliability of banks as suppliers of necessary and dependable infrastructure and business support was highlighted during the COVID-19 pandemic as they collaborated with governments to put fiscal support measures into place. The ongoing geopolitical tension and the rapidly globalizing world have pushed businesses and industries to adapt financial services. Banks are not only required but also trusted as providers of these services.

In a world of quick, real-time payments, how can banks remain competitive? You’re about to embark on a digital transformation journey; are you ready? How might adopting cloud-native technology support corporate growth? Why do you feel the need for it? Do you fear that you won’t discover the solutions you seek? The discussion of the phrase “cloud native” in this article’s major points will be held. Additionally, you will discover how to employ cloud-native features to increase your business’ innovation output and your development team’s productivity.

Digital Transformation in Banking Sector

In the upcoming days, cloud migration will take over the core banking platform. Transformation to a digital native platform will be the norm. Fintech and challenger banks are proving that cloud-based operations are successful, and customers enjoy the accessibility as well as the look and feel of new service offerings.

According to a survey by Markets and Markets, the global market for digital banking platforms is anticipated to increase from USD 8.2 billion in 2021 to USD 13.9 billion in 2026, with a CAGR of 11.3%. [1] As per the report, this growth results from both a rise in the adoption of cloud technology in banking institutions and a rise in the need among banks to provide the greatest client experience.

In terms of customers, a Statista analysis estimates that by the year 2024, 2.5 billion people will use online banking services. Online banking programmes, data encryption software, virtual assistants, KYC system software, website optimisation, etc. are a few instances of the movement of banking into the digital age.

At the same time, the winds of change have given rise to new forms of currency, with the emergence of over 22,000 cryptocurrencies listed by CoinMarketCap in early December. According to the World Economic Forum, the market for tokenized assets has the potential to reach a value of up to $24 trillion by 2027 [2]. The way we make global payments is changing because of changes in money and what people expect. The G20 group is working on making sending money across borders easier, faster, and cheaper. The financial industry has done well during difficult times, but we still need to ensure that new ways of sending money can work well with how things are done now.

What is Cloud-Native Application Development?

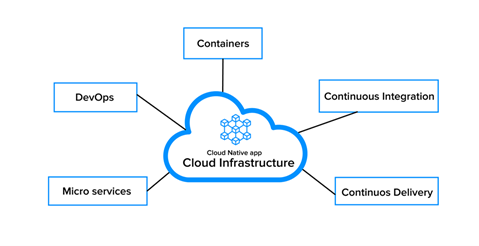

Cloud-native is a software development approach mostly based on cloud computing architecture. The goal of cloud-native application development is to exploit the adaptability, scalability, and resilience of cloud computing. Software developers employ various technologies and methods to create public cloud apps.

Microservices are the foundation for developing cloud-native apps. Any cloud system that uses discrete and reusable components is called a microservice. It is a multifaceted strategy that symbolizes a cycle that entirely emphasizes the journey rather than the final objective. It aids in creating new apps and updating the ones that already exist according to cloud computing concepts.

Why Should Banks Consider Cloud Native Technologies?

Effective technology infrastructure must possess key characteristics to function as the central point of clients’ operations. This includes adaptability to deliver services at the right speed, durability to handle large volumes and ensure security, and future-proofing to support legacy technology. The incumbents in the financial industry face significant IT operating costs due to the accumulation of layers of systems and code, along with regulatory fixes, fraud prevention, and cybersecurity efforts.

Fintech and platform giants have disrupted the financial industry by changing the technology landscape and moving the goalposts to new positions. The Boston Consulting Group emphasizes the need for corporate and investment banks to become client-centric, efficient, and agile, focusing on high-value areas and using digital practices and integrated processes to work smarter and leaner.

The digital revolution is also having a big impact on the financial sector. According to Avoka data, in the middle of 2017, mobile overtook desktop as the preferred method for requesting new deposit accounts at one of the top 10 U.S. banks [1]. Banks have grown their IT teams and technological investments to keep up with the times and digitize their offerings. Their goal is to make financial goods as convenient and easily accessible as those offered by customer service for technology.

Built Vs. Buy Mentality

The debate between buying pre-built software or building in-house digital onboarding software in bank IT departments is not a simple dichotomy. With today’s complex development landscape, this dualistic viewpoint is causing significant problems. A more nuanced approach is needed to determine the best solution, as both options have their own advantages and drawbacks. Banks frequently opt to develop their IT projects internally, although doing so results in overspent budgets and technical debt.

According to Forrester’s study, projects with components that are internally produced are more likely to experience issues and have a higher total cost of ownership. Technical debt can result in a never-ending cycle of catch-up repairs and expensive maintenance, which depletes development resources. Software releases aimed at customers are usually updated infrequently, particularly for projects that go over budget. Teams do not lack resources but encounter roadblocks due to rigid architectural design, subpar technology, and shifting business priorities.

The old “buy vs. build” argument is obsolete because third-party services are now completely adaptable and adjustable. Banks should adopt the new platform strategy, which entails purchasing standardized services and tools from outside vendors and developing one-of-a-kind components internally. This strategy lowers technological debt and distributes the cost of R&D among external players. Branding external components to the bank’s image is simpler and can be adjusted using the platform method.

How Can Cloud-Native Apps Help You Do the Development Fast?

Cloud-native applications are designed to be built, deployed, and scaled on cloud infrastructure. These applications use cloud-native technologies and architectures such as microservices, containers, serverless computing, and DevOps practices.

There are several ways that cloud-native apps can help you do development quickly:

Faster deployment: Cloud-native applications can be easily deployed on the cloud infrastructure, allowing you to deploy updates and new features faster.

Scalability: Cloud-native applications can be scaled up or down quickly to meet the changing demands of your users. This means you can quickly respond to traffic spikes or adjust your application’s resources to handle increased loads.

DevOps automation: Cloud-native applications are built with DevOps practices in mind, enabling you to automate your development, testing, and deployment processes. This helps to reduce the time required to release new features and updates.

Flexibility: Cloud-native applications are designed to run on any cloud platform, allowing you to choose the best platform for your needs. This means you can switch between cloud providers or move to a hybrid or multi-cloud environment as needed.

Collaboration: Cloud-native applications are built using a microservices architecture, allowing teams to work independently on different application components. This improves collaboration and speeds up development time.

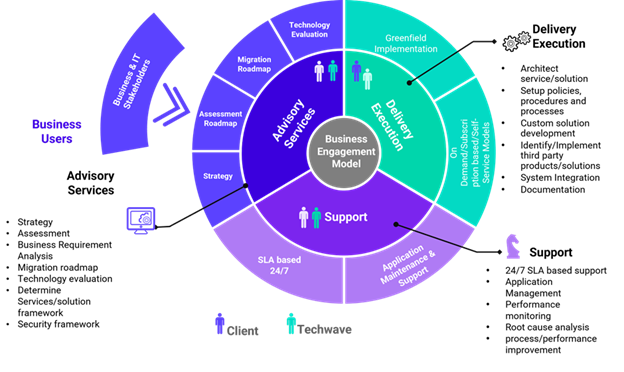

Techwave’s Approach to Bank’s Application Modernization

Techwave’s approach to application modernization would be BBEA: Buy, Build, Extend, and Assemble. The rule of thumb here is that while services and capabilities that are generic and not distinctive to the bank should be procured from specialist vendors, the bank’s core IP should be produced in-house. The overall solution can be expanded and assembled further. This is precisely what the new world of APIs and platforms provides.

Sourcing and extending components greatly decrease technical debt and spreads R&D costs across external players. The API and platform approach allow banks to adjust these external components to their brand and specific conditions more easily. It significantly reduces the burden of adapting to changing future needs, eliminating the need to frequently revert to large, costly start-from-scratch projects.

Techwave ‘s 10 key Tenets for Application Modernization

If you’re looking to modernize your applications, consider the following tenets in which the expertise of Techwave is specialized:

- We modernize the programming languages and frameworks that are optimized for containers, including support for multi-core processing, lightweight concurrency, fast compilation, container friendliness, reactive processing, and more. Good options include Go and Java with Quarkus. We choose a horizontally read-and-write scalable database that best fits your use case, such as one that is acid-compliant, document-oriented, time-series, column-family, graph, and more. To maximize read and write operations on datasets and achieve high levels of efficiency, think about applying CQRS principles.

- Design reactive systems whenever possible to improve application throughput.

- Choose a messaging backbone for services that do not require synchronous communication. This contributes greatly to application reliability.

- We implement a business rules system, such as Red Hat Decision Manager, from the ground up.

- Embrace DevSecOps principles while building applications.

- Manage the application lifecycle using an application orchestrator such as Kubernetes, Service Fabric, OpenShift, or Nomad.

- Use an “everything as code” approach, including unit and integration tests, configuration, infrastructure, and performance scripts.

- Refactor monolithic applications using microservices principles, such as single-responsibility, security, resilience, and scaling.

- Wherever possible, we use low-code or no-code solutions for quick wins, such as master data, internal apps, proof of concepts, or MVPs.

“The finance industry is undergoing a significant transformation with the adoption of digital payments, blockchain technology, and artificial intelligence, which have already revolutionized how we conduct financial transactions. Looking ahead, we anticipate even more developments in open banking, decentralized finance, and sustainable finance. In order to remain competitive and meet the evolving needs of digital customers, financial institutions must adopt a platform approach and embrace cloud-native technologies. Abandoning the outdated ‘build vs. buy’ mentality is essential to enable efficient and agile operations, future-proof legacy systems, and deliver high-value services with a superior client experience. However, the challenge lies in keeping up with the rapidly changing fintech landscape while maintaining customer trust and security. To succeed in the future of finance, it’s crucial to seamlessly integrate technology with human expertise. We’re confident in our ability to leverage both to create value for our clients.” said Sundar Kasturirangan, Senior Director- Fintech & Payments, Techwave.

Also read: Leverage open source reuse to scale your digital initiatives

Do Follow: CIO News LinkedIn Account | CIO News Facebook | CIO News Youtube | CIO News Twitter

About us:

CIO News, a proprietary of Mercadeo, produces award-winning content and resources for IT leaders across any industry through print articles and recorded video interviews on topics in the technology sector such as Digital Transformation, Artificial Intelligence (AI), Machine Learning (ML), Cloud, Robotics, Cyber-security, Data, Analytics, SOC, SASE, among other technology topics